Nongrantor Lead Trust

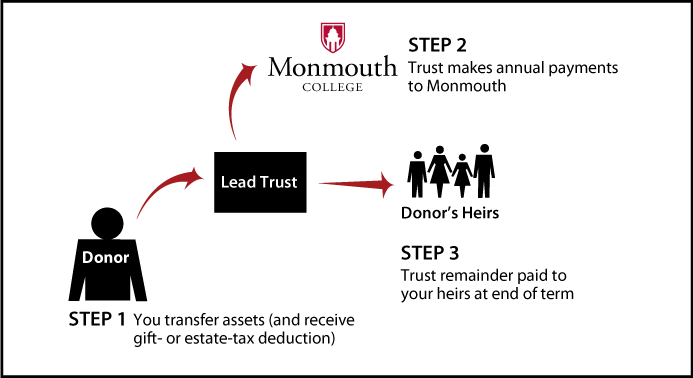

How It Works

- Create trust agreement stating terms of the trust (usually for a term of years) and transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes annual payments to Monmouth

- Remainder transferred to your heirs

Benefits

- Annual gift to Monmouth

- Future gift to heirs at fraction of property's value for transfer-tax purposes

- Professional management of assets during term of trust

- No charitable income-tax deduction, but donor not taxed on annual income of the trust

Request an eBrochure

Request Calculation

Contact Us

Gena Alcorn '88, CFRE

Assistant Vice President for Development and Legacy Giving

309-457-2427

galcorn@monmouthcollege.edu

Monmouth College

700 E. Broadway

Monmouth, IL 61462

Federal Tax ID Number: 37-0661228

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer